All of our Deluxe Premium Gas Fireplaces and Inserts feature the patented GreenSmart® System. This proprietary system is the most innovative collection of components, controls and technology that when combined provides an elegant, greener and smarter way to heat your home.

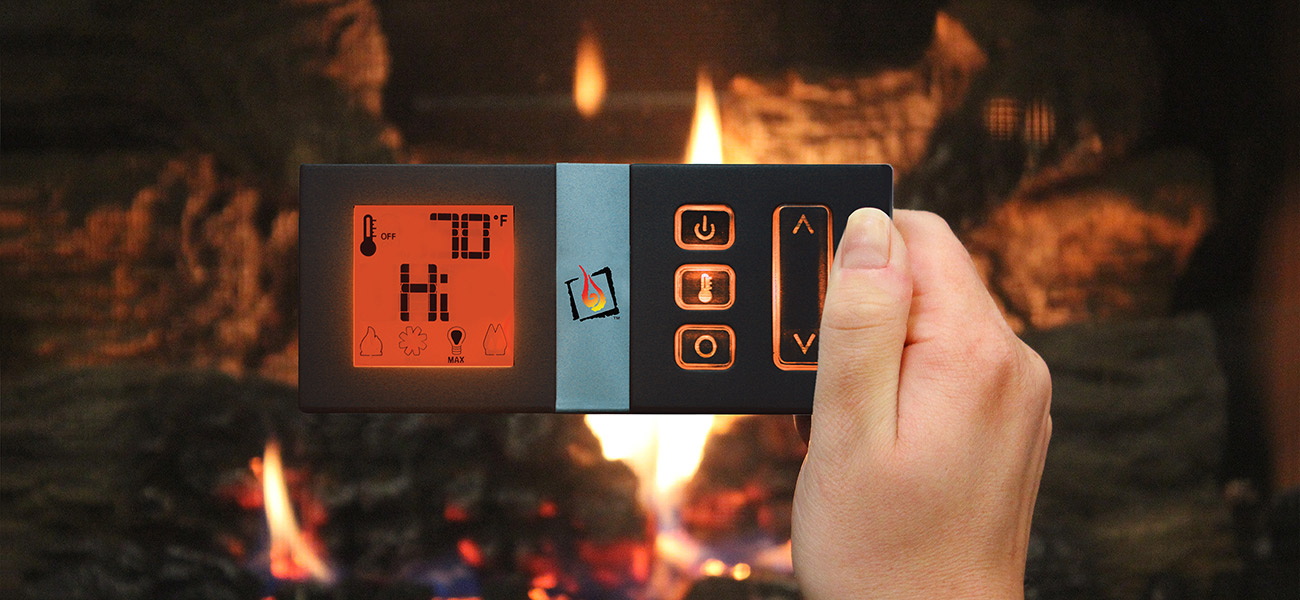

GreenSmart® Deluxe Multi-Function Wireless Thermostat Remote Control

(Optional with the 864 TSV See-Thru Gas Fireplace)

- Two Thermostat Modes

- Flame Adjustment (6 levels)

- Change Between GreenSmart® and CPI Pilot Modes

- Fan Operation (6 levels)

- Comfort Control™ (Controls rear burner)

- Accent Lights (6 levels)

Thermostat Setting

Fireplace or insert turns ON or OFF to maintain your desired home/room temperature.

Manual Setting

ON/OFF, Fire and Fan stay where you manually set it.

Smart Thermostat Setting

“Smart Thermostat Mode” automatically adjusts the flame height based on the temperature setting, so the flame will modulate up/down as opposed to shutting OFF/ON like normal thermostats. This setting conserves fuel and maximizes the fireplace or inserts heating ability while extending the viewing pleasure of the fire.

Flame Adjustment

Adjust the height/heat of the flame. 6 levels of flame heights to choose from.

Convection Fans

Circulate room air around the firebox and deliver heated air into your home. 6 speeds to choose from.

Comfort Control™

Comfort Control turns off the rear burner while leaving the front burner on for an attractive flame when heat output is not the priority. This feature offers a turndown ratio of up to 75 percent and offers a more efficient way to heat your home by only burning the correct amount of fuel to keep a constant room temperature.

(This feature is not available on the 4237 Gas Fireplace)

Choice of Pilot Modes

Easily Switch Between Pilot Modes

GreenSmart Mode:

Use in summer or milder heating days to reduce gas consumption from the Pilot.

CPI – Continuous Pilot Mode:

Keeps the Pilot on at all times. This warms the vent system to maintain a strong draft in your chimney and reduce moisture condensation on the glass. Used in Fall/Winter or in cold climate areas. The GreenSmart® system includes a battery back-up, ensuring proper ignition even during power outages.

Accent Lights

Accent Lights are a standard feature in all Deluxe fireplaces and inserts. This feature adds a warm glow to both the logs and fireplace interior, and can be used when the fire is on or off. Perfect as a nightlight or soft indirect light for the room, the Accent Lights allow for visual enhancement of your fireplace or insert 365 days a year. 6 levels to choose from.

Accent Lights Off Accent Lights On

Firefly Lodge in Merrill, Wisconsin serves customers throughout North Central Wisconsin to keep their homes warm in the winter. From Wausau to Mosinee, Stettin and north Firefly Lodge has what you need to keep you warm in the winter months. Contact Us to Today to find out how we can help.